WORTH SUPPORTING

Checking in on enhanced financial aid

Financial aid made it possible for Dan Kuhr '13 to attend Cornell. See larger image

Dan Kuhr '13 spent months in fearful anticipation during his senior year of high school, wondering which colleges would accept him – and just as important, how much financial aid they would offer.

Kuhr's family, which owns a small consulting business, earns $70,000-$100,000 annually, but most of their assets are not liquid in savings and securities.

"I was afraid of getting into the schools of my dreams and not being able to go ... just because I don't come from a family that owns a yacht and summers on Martha's Vineyard," says Kuhr, the first person on his father's side to attend college. "I was afraid of the disappointment."

Two other top-tier schools admitted Kuhr but with little financial aid; Cornell offered to cover half his costs, including tuition, room and board, books, mandatory fees, personal expenses and a small travel stipend.

"Cornell came through," Kuhr says. "If [my family] were getting no aid, I just straight up wouldn't be going to Cornell right now."

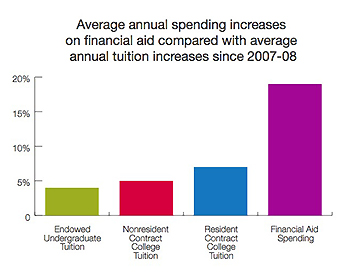

Kuhr is among the half of all Cornell undergraduates benefiting from the university's financial aid program, which has been substantially expanded since 2008. While the cost of an undergraduate education at Cornell's endowed colleges has increased an average of 4.6 percent yearly since then, Cornell's financial aid has grown on average nearly 20 percent annually during the same period. Cornell now spends some $224 million annually on financial aid that benefits roughly 7,000 undergraduates.

Ensuring Cornell's affordability regardless of financial need has been a top priority of President David Skorton. "Cornell is the original 'opportunity university,' and we still carry forward our founder's vision of inclusion," he said in his October 2011 State of the University Address. Even during the "Great Recession" of 2007-09, Cornell didn't just maintain its need-blind admissions policy but also enhanced financial aid to low- and middle-income students (see sidebar), "so that they could graduate without a crushing burden of debt," Skorton said. "We are proud of this commitment to access and to the diversity within our student body it fosters."

The expanded financial aid has resulted in greater access for students from lower- and middle-income families, says Lee Melvin, Cornell's associate vice provost for enrollment. For example, children from families with incomes less than $75,000 a year pay less to attend Cornell than they did a decade ago.

The new policies benefit both low- and middle-income students. Nearly 28 percent of students receiving financial aid are from the lowest 40 percent of household incomes nationwide – those earning less than $48,000 per year. More than 42 percent of students receiving aid come from families earning $74,000-$114,000.

The enhanced financial aid has also made the student body more geographically and ethnically diverse. For example, students in the Class of 2015 hail from 48 states as well as Washington, D.C., and Puerto Rico, and more than 36 percent identify themselves as students of color, Melvin says. "Our financial aid supports highly qualified students regardless of their social status, ethnicity or geography," he says. That diversity attracts a broader pool of candidates, which in turn enhances the university's selectivity, Melvin added.

Financial aid is a key component of the university's $4.75 billion fundraising campaign, "Cornell Now." The campaign seeks to raise $350 million for undergraduate and international student scholarships, says Charlie Phlegar, vice president for alumni affairs and development. "Compared with other schools with aggressive aid plans, Cornell has a larger student body and enrolls a greater number of lower-income students. This means that Cornell must spend more to reduce loans for students," he says. "However, it also means that Cornell has the chance to change many more lives."

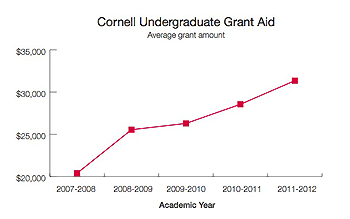

Average annual spending increases on financial aid compared with average annual tuition increases since 2007-08. See larger image  Cornell undergraduate grant aid, average grant amount, 2007-08 through 2011-12. See larger image Cornell's enhanced financial aid programsStarting in 2008, Cornell expanded its financial aid programs over a two-year period. In 2008-09, the university replaced need-based loans with grants for undergraduates from families with incomes less than $60,000; it capped loans at $3,000 annually for students from families with incomes $60,000-$120,000. In 2009-10, the program took full effect, replacing need-based loans with grants for students from families with incomes up to $75,000, and capping annual loans at $3,000 for students from families with incomes $75,000-$120,000. Loans were capped at $7,500 for students from families with incomes above $120,000 who qualify for need-based financial aid. In 2011-12, Cornell began matching the need-based financial aid of other Ivy League schools for applicants who were also accepted at those schools. And it began striving to match the financial aid for students also accepted at Duke, MIT and Stanford. |